CGTMSE Scheme

The Ministry of Micro, Small & Medium Enterprises (MSME) launched the Credit Guarantee Scheme (CGS) in order to improve the credit delivery system in the country and streamline the flow of credit to the Micro and Small Enterprise (MSE) sector.

To make this scheme operational, the Indian government and SIDBI created the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Availability of bank credit without the hassles of collaterals / third party guarantees would be a major source of support to the first generation entrepreneurs to realise their dream of setting up a unit of their own Micro and Small Enterprise (MSE). Keeping this objective in view, Ministry of Micro, Small & Medium Enterprises (MSME), Government of India launched Credit Guarantee Scheme (CGS) so as to strengthen the credit delivery system and facilitate flow of credit to the MSE sector. To operationalise the scheme, Government of India and SIDBI set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Related topics

Eligible Borrowers

All Existing and New Micro and Small Enterprises (MSEs)

Lending Institutions offering funds under CGTMSE Scheme

Scheduled Commercial Banks (SCBs)

Regional Rural Banks (RRBs)

Small Finance Banks (SFBs)

Non-banking Financial Companies (NBFCs)

Small Industrial Development Bank of India (SIDBI)

National Small Industries Corporation (NSIC)

North Eastern Development Finance Corporation Ltd. (NEDFi)

Small and Micro-Enterprises owned and/or operated by Women Entrepreneurs are eligible for a Guarantee Cover of 80%, whereas all the credit/loans in the North East Region (NER) for credit facilities are eligible for a guarantee of Rs. 50 lakh.

Guidelines

The lender should cover the eligible credit facilities as soon as they are sanctioned. Guarantee will commence from the date of payment of guarantee fee and shall run through the agreed tenure of the term credit in case of term loans / composite loans and for a period of 5 years where working capital facilities alone are extended to borrowers, or for such period as may be specified by the Guarantee Trust in this behalf.

Credit Guarantee Funds Trust for Micro and Small Enterprises (CGTMSE) is a trust established by the Government of India, under the Ministry of Micro, Small and Medium Enterprises (MoMSME) and Small Industries Development Bank of India (SIDBI). Launched in 2000, the CGTMSE scheme offers credit guarantees to financial institutions that offered credit facilities up to Rs. 2 crores and has now been raised to Rs. 5 crores. CGTMSE scheme offers credit guarantees from 75% to 85% to MSEs across India.

CGTMSE Scheme – Highlights

Interest Rates

As per RBI’s Guidelines is eligible for coverage under CGTMSE

Eligible Activities

Manufacturing and Services including Retail

trade is allowed

Educational and Training institutions, Self

Help Groups (SHGs), and agriculture-

related activities are not eligible

Guarantee Coverage

· For Micro and Small Enterprises (MSEs)– Credit facility up to Rs. 500 lakh can be covered on an outstanding basis

· For Regional Rural Banks (RRBs) and Select Financial Institutions credit facilities up to Rs. 50 lakh is allowed

Collateral / Third Party Guarantee

From 75% – 85% (50% Coverage for retail activity)

Eligible Member Lending Institutions (MLIs)

Not required

Annual Guarantee Fee for amount up to Rs. 1 crore

More than 100: PSUs, NBFCs, RRBs, Private Banks, SUCBs, Fls, SFBs, and Foreign Banks

Collateral / Third Party Guarantee

Fee revised from 2% and reduced to as low as 0.37%

Credit Guarantee under CGTMSE Scheme

Credit Guarantee refers to a situation where the loan to the applicant is backed by a party without the need for any external collateral or third-party guarantee. Here, the loan sanctioned by the member lending institution is backed by the scheme which provides the guarantee cover for a large portion of the loan amount. Under the CGTMSE scheme, both new and existing micro and small enterprises, including manufacturing and service enterprises are eligible for a credit facility of up to Rs. 5 crores.

Benefits of CGTMSE Scheme

Ceiling for Guarantee coverage raised from Rs. 200 lakh to Rs. 500 lakh

Guarantee fee reduced to diminish the overall cost of borrowings to MSEs

Micro Finance Institutions as Member Lending Institutions (MLIs) are now eligible

Concessions related to fees and increased coverage to SC/STs

Reduced Guarantee fee by 10% and coverage extent increased to 85% to Women, ZED Certified Units and Units in Aspirational Districts

Annual Guarantee Fee structure revised and fee reduced to as low as 0.37%

CGTMSE Coverage Criteria

a) The trust guarantees up to 75% of the defaulted principal amount (up to 85% of the defaulted principal amount for a select category of borrowers). The cover comes with a maximum guarantee cap of Rs. 37.50 lakh for the credit facilities up to Rs. 50 lakh.

b) The term credit including interest on the principal is covered for a period of one-quarter and/or outstanding capital advances including the interest, as on the date of the account becoming a Non-Performing Asset (NPA) or as on the date of filing the suit (whichever is lower).

c) Other charges, such as penal interest, commitment charge, service charge, or any other levy/ expenses do not qualify for the guarantee cover.

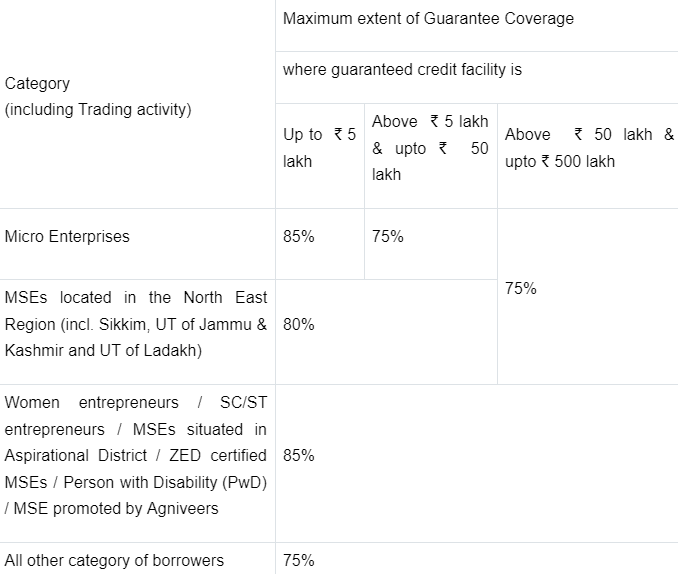

Below mentioned is the detailed information on the coverage limit under CGTMSE:

Documents required for loan application

Below stated are the documents required for a Loan under the CGTMSE scheme and its coverage:

Duly filled CGTMSE loan application form with passport-sized photographs

Business Incorporation or Company Registration Certificate

Business Project Report

CGTMSE Loan Coverage Letter

Copy of loan approval from the Bank

Any other document required by the Bank

Steps to avail Business/MSME Loan under the CGTMSE Scheme

The objective of the CGTMSE is to enable the banks to look at small and micro businesses with objectivity and give more importance to project viability and business model validation. To cover the loan under the credit guarantee fund scheme, the borrower has to pay an additional guarantee fee and service charge in addition to the interest charged by the bank. The current CGTMSE fee is payable at the rate of 1.5%. It is payable at 0.75% for the North-Eastern region including the state of Sikkim.

The procedure for applying and availing loans under CGTMSE is as follows:

Step 1. Formation of the Business Entity

Before even starting the procedure for loan approval under the CGTMSE, the borrower has to incorporate a private limited company, limited liability partnership, one-person company, or a proprietorship according to the nature of the business and obtain necessary approvals and tax registrations for executing the project.

Step 2. Preparing a Business Report

Borrowers need to conduct a market analysis and prepare a business plan containing relevant information, such as business model, promoter profile, projected financials, etc. The report is then presented to the credit facility and an application is filed for getting the loan under the CGTMSE scheme. However, businesses should consider that such project reports be prepared by experienced professionals. This shall increase the chances of approval.

Step 3. Sanctioning of Loan from the Bank

The request for a bank loan usually contains credit terms and working capital facilities. After the application and business plan are under process, banks carefully analyze the viability of the business model and process the loan application, and accord sanction, as per the bank’s policy.

Step 4. Obtaining the Guarantee Cover

After the loan is sanctioned, the bank applies to CGTMSE authority and obtains the guarantee cover. If the loan is approved by CGTMSE, the borrower will have to pay the guarantee fee and service charges. The CGTMSE loan application form can be downloaded from its official website.

The extended list of Member of Lending Institutions (MLIs) under the CGTMSE scheme contains 141 banks including all the major rural, urban, public sector, and private sector banks of India. The list contains some of the larger banks, such as the State Bank of India, United Bank of India, Punjab National Bank, etc.

Note: CGTMSE does not grant any loan, credit facilities, or subsidies and nor does it have any Loan Agents, Agencies for arranging loans, or credit guarantees offered via its MLIs.

Claim Settlement Procedure

After the disbursal of the final part of the loan amount, there is a lock-in period of 18 months for a preferred claim. The lender shall prefer a claim once the defaulted account has been notified as an NPA. The commencement of recovery proceedings after the account is called an NPA is known as the CGTMSE claim settlement procedure.

Important points to remember

85% guarantee for:

Women

sc/st entrepreneurs

Micro enterprises getting upto 5 lakh loan

Aspirational districts

ZED certified units

Pwd

MSEs promoted by agniveers

In NER and border states,there is a guarantee of 80%, if project cost is upto 50 lakhs.

And in almost all of rest cases ,there is 75% guarantee

Guarantee fee is 0.37% is 1.30% p.a

No legal action upto the default of 10 lakhs

ELIGIBLE ENTERPRISES

MICRO [assets-upto 1cr, turnover-upto 5 cr]

SMALL [assets-upto 10cr, turnover-upto 50 cr]

Purpose:

Term loan for :– Purchase of plant & machinery, Construction of building

Working capital

How to apply:

Greenfield projects:- new projects/first business by an entrepreneur without experience. Public sector banks are preferred for this.

Expansion project:- finance requirements for expansion of existing projects,Both public and private sector banks preferred.

How to get:-

Detailed understanding of business

Provide small collateral if possible, lets suppose you have a need of loan worth 5cr,and guarantee is up to 75% .Bank will get covered by CGT for 75% of loan amount, rest is advisable to be covered by a collateral.

Don't depend on any 1 bank, give proposals to multiple banks.

Professional help.[DPR, CREDIT UNDERWRITING ,DUE DILIGENCE]

Other points

10-12%, linked to repo rate

Disbursement upto 3 months

To avail any kind of assistance

contact us

Contact us

Like what you’ve seen? Get in touch to learn more.